Car sharing, a facet of smart mobility, is an innovative model rapidly expanding in the car rental industry. What began as a niche alternative to private ownership is now a mainstream service in dense cities and university towns, and it is gaining ground in commuter suburbs as pricing, telematics, and access technology improve. The appeal is straightforward for customers and operators alike: members gain reliable access to vehicles without long term commitments, while operators turn parked assets into productive ones with data driven utilization and transparent costs. This trend is accelerating in the United States, Denmark, and beyond, and it is reshaping how fleets, municipalities, and property owners think about curb space and mobility demand.

The Rise of Shared Mobility Economy

Car sharing is a cornerstone of the shared mobility economy that makes privately owned or professionally managed vehicles available to verified users on demand. The model borrows successful ideas from the broader sharing economy in accommodation and workspace by pairing a simple booking experience with strong back office workflows for safety, billing, and service quality. When the telematics, payments, and operations stack are aligned, car sharing complements transit and micromobility, reduces the need for second cars, and creates measurable environmental benefits through fewer vehicle miles traveled and more efficient fleet use.

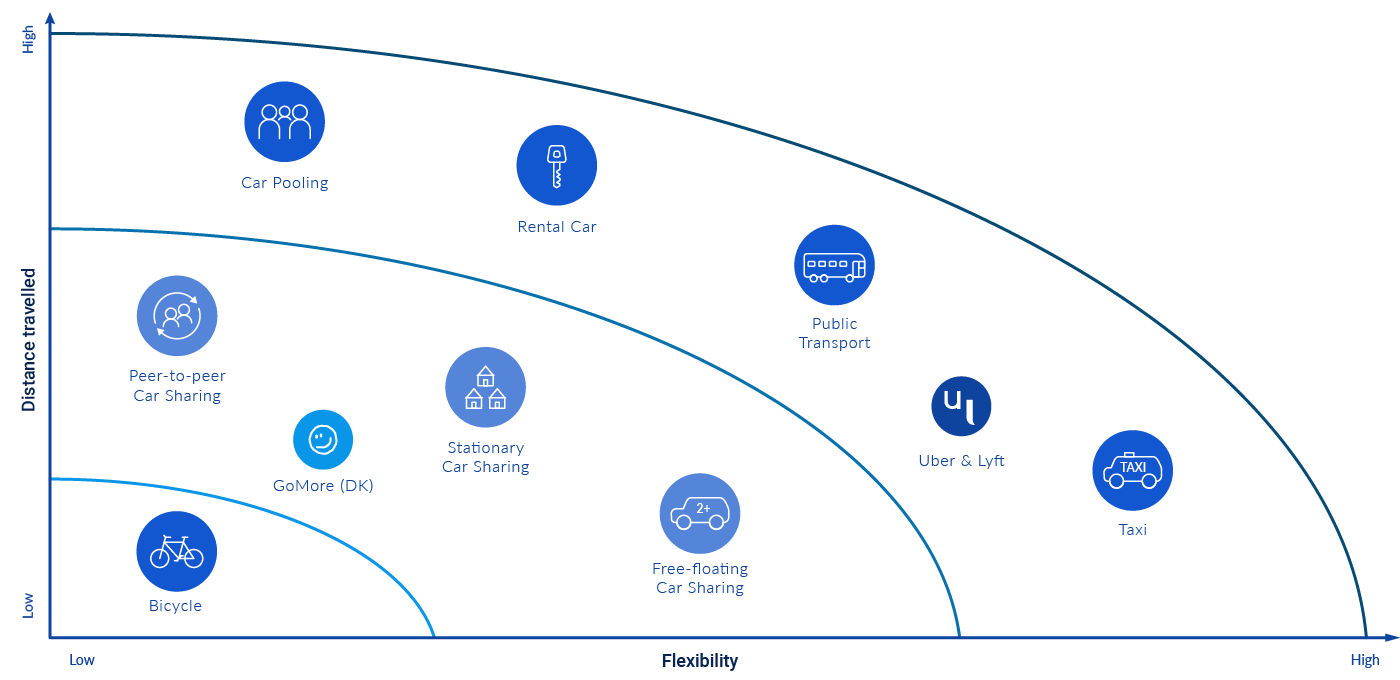

Significant players such as Uber and Lyft have proven the demand for app based mobility, while regional operators like Denmark’s GoMore demonstrate how local partnerships and policy alignment unlock supply and parking. These services do not replace traditional rental outright. Instead, they extend it with shorter bookings, unattended access, and flexible pricing that make shared vehicles a practical, economical choice for errands, weekend trips, and occasional car use.

What is Car Sharing?

Car sharing is a membership service where people rent or share cars for short periods, often by the minute or hour, with the entire experience handled through a mobile app or web portal. Unlike counter based rental, identity and license checks are completed digitally, access is granted securely in the field, and usage is tracked automatically for accurate billing and compliance. Think of it as a library for cars. You take the vehicle you need when you need it, return it when you are finished, and the platform readies it for the next member.

The model is community driven. A shared platform coordinates reservations, unlocks, and payments so members can enjoy the benefits of private vehicles without the fixed costs of ownership. Providers range from dedicated operators like Zipcar to established rental companies and property owners who deploy small station based fleets for residents and tenants. The value proposition extends beyond convenience to sustainability, since fewer cars can serve more trips when availability, pricing, and operations are designed around real demand.

Sustainability goals are central to modern car sharing. Programs reduce unnecessary ownership, support mode shift to transit and cycling, and encourage efficient vehicle use. When combined with electric vehicles and transparent pricing, car sharing helps cities lower emissions and meet access goals without expanding private parking supply.

Business Models and Where Each Wins

Operators generally choose between free floating zones, round trip or station based networks, corporate pool programs, and peer to peer listings. Each model has distinct economics, operations needs, and policy considerations. The table summarizes the trade offs so you can match the model to your market density, parking access, and staffing strategy.

| Model | How it works | Strengths | Operational watchouts |

|---|---|---|---|

| Free floating | Pick up and drop anywhere inside a geofenced zone with published parking rules. | High convenience and spontaneity in dense areas with mixed uses. | Rebalancing, parking compliance, cleaning cadence, and charging coordination. |

| Round trip or station based | Reserve from a fixed bay and return to the same bay at trip end. | Predictable availability, simpler permitting, easier charging and cleaning. | Lower walk up demand and the need for strong advance booking UX. |

| Corporate fleets | Employees share pool vehicles for business trips or commute programs. | Cuts reimbursements and taxis, improves utilization across departments. | Policy alignment for parking, damage flows, and after hours access. |

| Peer to peer | Owners list vehicles; platform handles KYC, access, and insurance. | Asset light growth with strong suburban coverage. | Quality control, fraud prevention, and insurance complexity. |

How Does Car Sharing Work?

Car sharing operates on a distributed network of vehicles that members can find, reserve, unlock, and drive with a phone. Registration, identity checks, and payment authorization happen once, after which the user can browse live availability, compare pricing, and reserve the nearest suitable vehicle. Services may run round trip bookings that return to a bay or free floating trips that end anywhere in a defined zone, with clear city rules for parking and charging. Accurate telematics tie each trip to real time location, motion, and odometer so billing is precise and audits are simple.

After reserving, the member walks to the vehicle, authenticates through the app or a card, and the system releases the immobilizer and unlocks the doors. Similar to keyless entry, access works even in poor coverage areas using Bluetooth or cached credentials. Insurance, maintenance, and fuel or charging are typically handled by the operator and priced into the trip, while cleaning and rebalancing follow a repeatable field playbook. Members pay for time and distance with transparent fees for zones, deposits, or extras. When not in use, the vehicle immediately returns to the pool for the next member, which keeps utilization high and streets less crowded.

Core User and Operations Flows

Strong services standardize a handful of flows so the experience feels simple to riders and predictable to operators. New users complete KYC and license verification in minutes, reservations preview zone rules and pricing, and unlock is instantaneous with a reliable fallback when cellular service is weak. In the background, telematics monitor motion and door status, the platform enforces geofences and curfews, and field teams receive actionable work orders for cleaning, charging, damage, or rebalancing.

- Signup with ID and license checks plus payment authorization

- Search and booking with photos, SOC or fuel level, and clear zone rules

- Secure unlock, immobilizer release, and trip start events

- In trip support for parking, charging, and incident reporting with photos

- Trip end validation, odometer capture, and automated billing

- Cleaning, charging, rebalancing, and damage resolution workflows

Telematics and Access Control Stack

The device and cloud stack determine reliability, security, and total cost. Vehicles require a telematics unit that reads CAN or OBD signals, exposes digital I/O for door locks and immobilizer, provides high accuracy GNSS, and supports Bluetooth or NFC for low latency access. Cloud rules evaluate geofences, exceptions, and parking policies, while APIs and webhooks connect the mobility app, payments, and KYC providers. The table below captures the essential layers.

| Layer | Requirement | Notes |

|---|---|---|

| Device | GNSS, LTE, CAN or OBD, digital I/O for locks and immobilizer, BLE/NFC | AutoPi TMU CM4 or CAN-FD Pro for mixed ICE and EV fleets. |

| Edge logic | Offline buffering, tamper detection, trip start and stop | Keeps access responsive when coverage is weak. |

| Cloud | APIs, webhooks, geofences, alerting, audit logs | Integrates app, payments, and KYC for end to end control. |

| Security | Device identity, signed firmware, role based access | Protects vehicles and customer data at scale. |

Pricing Structures and Fees

Pricing should be simple to understand and flexible enough to guide demand. Operators commonly combine a per minute or hour rate with a distance fee, then cap daily or multi day use. Deposits, cleaning charges, young driver fees, and zone surcharges must be transparent before checkout to reduce disputes and support healthy unit economics.

| Component | Typical value | Best use |

|---|---|---|

| Per minute or hour | $0.25–$0.45 per minute or $8–$15 per hour | Short urban trips and errands |

| Per km or mile | $0.20–$0.35 per mile | Controls long distance exposure |

| Day cap | $55–$95 per day | Weekend and tourism demand |

| Membership | $5–$20 per month | Improves retention and fraud screening |

Understanding Car Sharing: The New Norm of Car Rental

Car sharing is designed for short distance, short duration trips that extend the transportation network rather than duplicate it. Programs may be operated by commercial providers, public agencies, cooperatives, or property owners who manage resident fleets. Members enjoy the benefits of access to private cars without ownership burdens, while cities gain tools to manage curb demand and reduce congestion with data that proves impact.

Car Sharing in the United States and Denmark

In the United States, adoption is strongest in high density neighborhoods from New York to the West Coast, with university towns showing durable demand for station based fleets. In Denmark, GoMore pairs shared cars with ride sharing to cover both occasional and habitual needs, and it works closely with municipalities on parking and policy. Across markets, the winning implementations align pricing, parking access, and field service so vehicles are where members need them at predictable times.

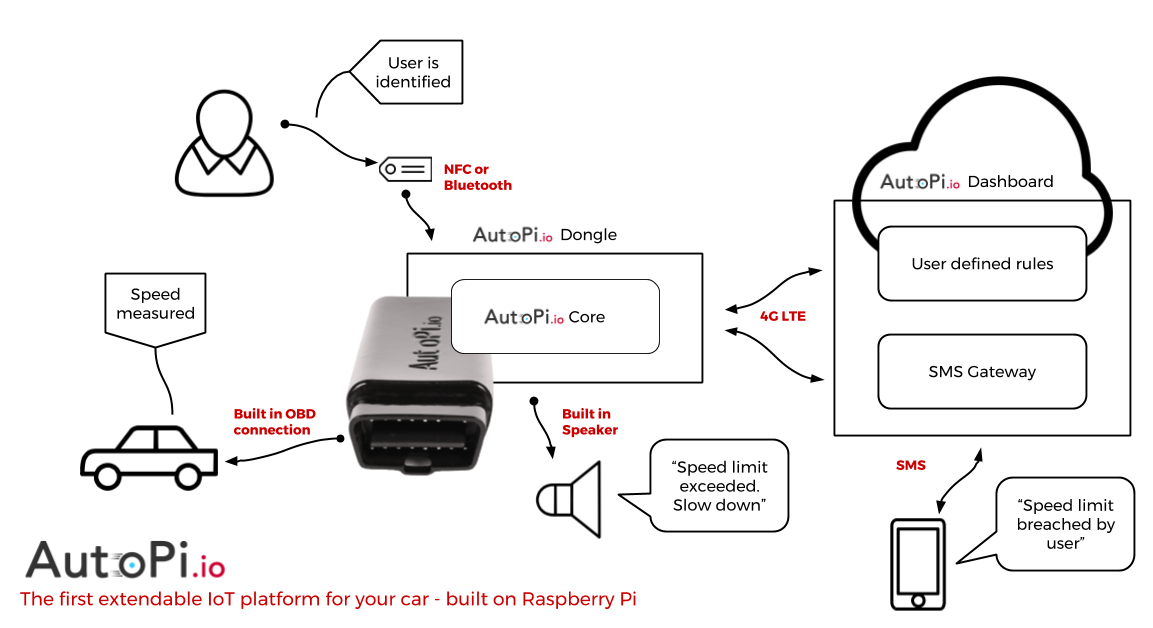

AutoPi and Car Sharing: A Technological Breakthrough

AutoPi’s IoT platform addresses the core challenge of unattended access and reliable telemetry. The AutoPi device reads CAN or OBD signals, controls locks and immobilizer, captures high accuracy location, and supports Bluetooth for local unlock. Paired with AutoPi Cloud, operators monitor vehicle health, automate geofence rules, push trip events to the mobility app, and integrate KYC and payments through APIs and webhooks. The result is a secure, flexible stack that works across ICE and EVs and scales from small property fleets to city wide networks.

Beyond access, the TMU continuously updates the vehicle’s status and diagnostics, flags exceptions such as low state of charge, and streams odometer and event data for accurate billing. This closes the loop between the field and back office so issues are resolved quickly and vehicles return to service faster, which improves utilization and member satisfaction.

Luxury Vehicles in Car Sharing

Luxury and electric vehicles are increasingly common in car sharing. Operators use pricing and deposits to protect assets while giving members access to premium experiences for special occasions. For EV fleets, telematics driven charging workflows are essential so vehicles are returned with adequate state of charge and users receive clear guidance on charging etiquette during longer bookings.

Insurance and Car Sharing: Safeguarding Interests

Insurance protects both the operator and the member and should be explained clearly in the app before checkout. Many providers bundle liability and physical damage coverage and offer optional reductions for deductibles. Transparent damage documentation with time stamped photos and tamper proof logs reduces disputes and speeds claims resolution, which keeps vehicles on the road and users confident in the service.

KPIs and Unit Economics

Operators track a focused set of metrics to guide pricing, zones, and field staffing. Utilization, revenue per available vehicle hour, incident rate, cleaning cycle time, and payment approval rate are reliable leading indicators. Consistent weekly reviews drive quick adjustments before small issues become expensive problems.

| KPI | Definition | Healthy range |

|---|---|---|

| Utilization | Booked time divided by available time | 25–40% weekday peak in urban zones |

| RevPAH | Revenue per available vehicle hour | $3.50–$6.00 depending on mix |

| Cleaning cycle | Average hours between service tasks | 24–72 hours based on demand |

| Incident rate | Damage or tow events per 100 trips | < 1.2 per 100 trips |

ROI Mini Calculator

The quick model below shows how a compact urban launch can pay back hardware rapidly when utilization is healthy and cleaning cycles are efficient. Replace the inputs with your assumptions to estimate payback and three year value before scaling to additional neighborhoods.

| Input | Value | Comment |

|---|---|---|

| Vehicles | 50 | Initial free floating zone |

| Capex per vehicle | $1,500 | Telematics, locks, installation |

| Monthly platform + connectivity | $18 | Per vehicle |

| RevPAH | $4.20 | At 30% utilization |

| Gross monthly revenue | $151,200 | 50 vehicles × 24h × 30d × RevPAH |

Car Sharing Globally: A Broadening Horizon

Adoption is expanding across continents as cities pursue climate and access goals. Operators are growing fleets, adding EV options, and partnering with property owners for dedicated parking in residential and commercial buildings. The result is a more flexible and cost efficient alternative to private car ownership that changes how people think about vehicles. With clear policy, reliable telematics, and strong operations, car sharing becomes a durable part of the mobility mix rather than a short lived pilot.